We created enjuba with two arms, an online clothing and apparel company that sold products made by Ugandan artisans to customers in the US from 2006-2008 and a social entrepreneurship program we developed at a Ugandan secondary school in 2007. We also designed a savings, investment, and micro-credit program for enjuba artisans. Below is a brief overview of enjuba, including many of the people who were involved with enjuba since it began in 2005 as an idea we had at a bagel shop in Nashville, Tennessee when we were freshmen at Vanderbilt University. We are thankful for the collaboration we were able to have with everyone and grateful for the incredible amount of time and support given to us and enjuba.

In 2008 we decided to switch gears and focus on selling in Uganda instead of in the US, which included transferring ownership of the company to the enjuba artisans and Aaron Kirunda, who was managing the artisans, product development, and operations. Under the leadership of Aaron, enjuba opened a store in the capital city, Kampala, and continued developing and selling products. After running the store for a year, however, the artisans decided to instead develop their own businesses independently. Although the enjuba store closed, Aaron has stayed in close touch with several of the artisans to help them strengthen each of their businesses- teaching them standard accounting practices, developing business growth plans with them, and offering loans so they can continue to grow.

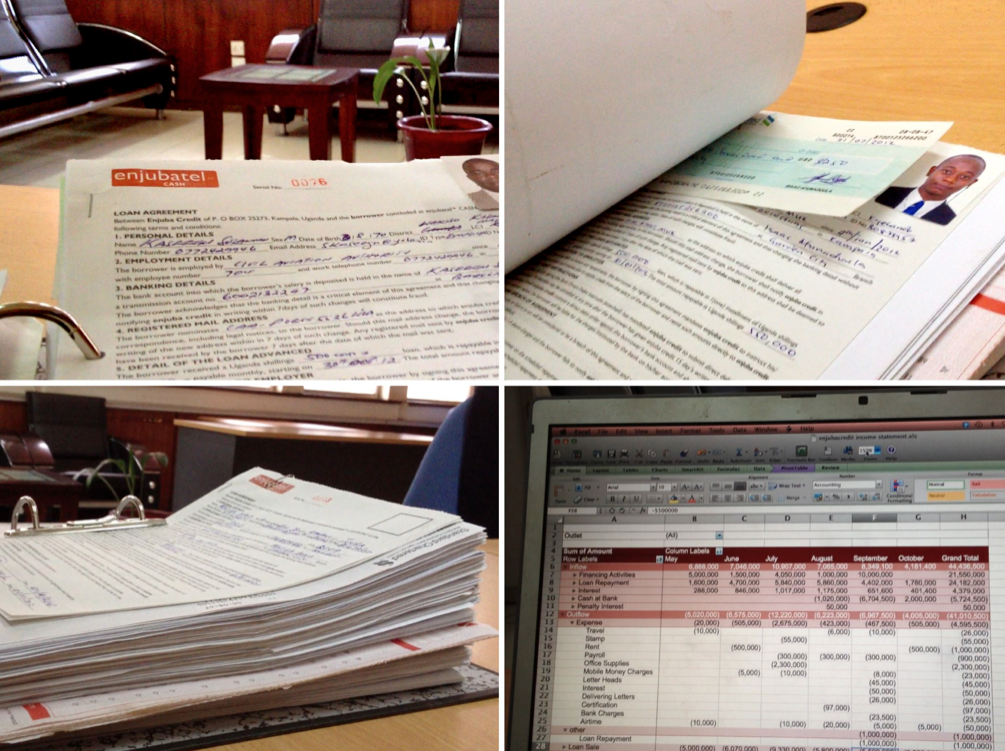

The main focus of Aaron since 2010 has been transforming the enjuba brand into a bank, now called enjuba Credit, in order to bring more economical financial services to Uganda. Enjuba Credit currently gives out short term loans to individuals and is developing a program for longer term loans. The company also allows individuals, businesses, hospitals, and other organizations to securely and inexpensively send money and pay bills using their mobile phones, and it allows customers to make cash deposits and withdrawals by crediting or debiting their phone accounts. Aaron’s business has hundreds of customers and has facilitated thousands of transactions. Enjuba is also working to design, develop, and host a national spelling bee with the intent of having more parents actively engaged in the education of their children within the context of an exciting competition. Aaron intends to introduce words such as responsibility, accountability, transparency, and anti-corruption, and ensure that the kids understand the full context and implications of these words. Enjuba Credit will be the main driver of this initiative, but Aaron intends to get numerous other companies and organizations to support the enjuba spelling bee.

Thanks for stopping by!

Wil Keenan and Henry Manice

Enjuba co-founders

2005

We came up with the idea for starting enjuba in 2005 while exploring (over a bagel at Bruegger’s in Nashville, Tennessee) whether we could use business to have a positive impact on Uganda. We aimed to create a for-profit business that could fund our own non-profit initiative. We decided the for-profit business would be an online clothing company with products made by Ugandan artisans, and since we were both into video and photography, we planned to connect the artisans with customers in the US through our website. We figured it would be best to explore ideas for the non-profit arm once we got over to Uganda.

|

|

2006

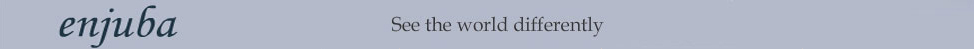

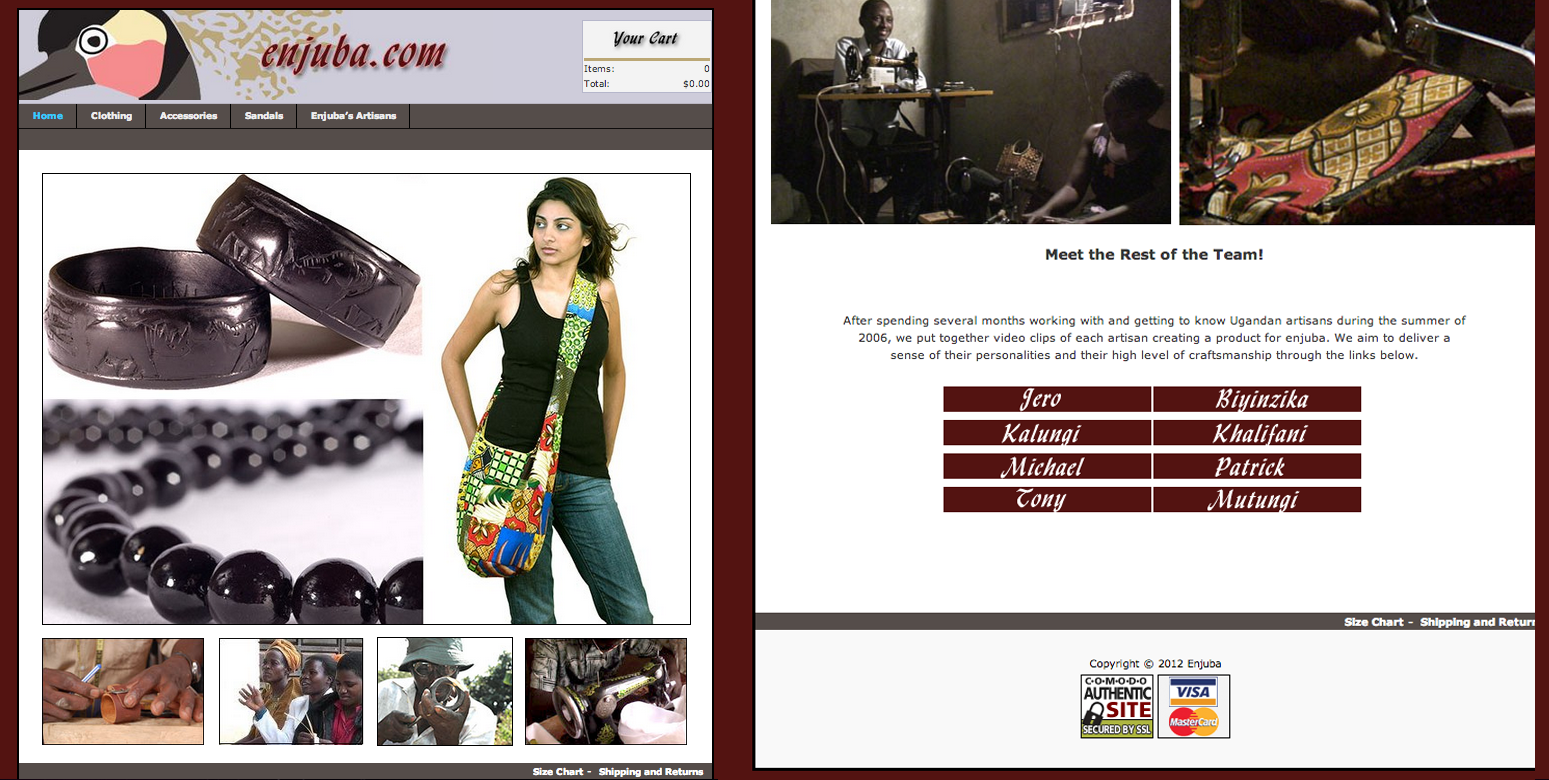

We spent two months in Uganda after finishing up our freshman year at Vanderbilt University building a group of artisans and creating a line of products. Francis Kadoli helped us find and develop relationships with the artisans. Kaili Holtermann, a fellow Vanderbilt student, joined us in Uganda to design products and strengthen the artisan team. In the fall we launched our online store, which was designed by David Amouyal, also a student at Vanderbilt. The purpose of enjuba.com was to sell fashionable, unique, and high quality items that have stories of empowerment, inspiration, and innovation behind each of them. Vanderbilt students Ashley Kushner, Annsley Miller, Jade Morales, and Kaitlin Gibler greatly supported our campus sales and marketing. Enjuba products were modeled by Alia Eads, Ally Boynton, Anita Jivani, Ayia Gospondinova, Catherine Hambleton, Dionna Barnes, Emily Manice, Harriet Manice, Heajoo Kim, Kaitlin Gibler, Rachna Patel, and Shelby Gambrell.

|

|

|

|

|

2007

During our second visit to Uganda in 2007, we developed our non-profit arm, a social entrepreneurship program at a Ugandan secondary school, in partnership with Ashoka Fellow Irene Mutumba and the Private Education Development Network. The program was developed with Graham Saunders, a student at UNC Chapel Hill, Meredith Bates, a Vanderbilt alumna who was living in Uganda at the time, and Aaron Kirunda, a graduate of East Africa’s leading university, Makerere. That summer we also set up a savings, investment, and micro-credit program for enjuba artisans, and Leah Morgan, a Vanderbilt masters student, designed new products and conducted team building activities.

|

|

|

|

|

|

2008-2009

In 2008 we decided to switch gears and focus on selling in Uganda instead of in the US, which included transferring ownership of the company to the enjuba artisans and Aaron Kirunda, who was managing the artisans, product development, and operations. Under the leadership of Aaron, enjuba opened a store in the capital city, Kampala, and continued developing and selling products. After running the store for a year, however, the artisans decided to instead develop their own businesses independently. Although the enjuba store closed, Aaron has stayed in close touch with several of the artisans to help them strengthen each of their businesses- teaching them standard accounting practices, developing business growth plans with them, and offering loans so they can continue to grow.

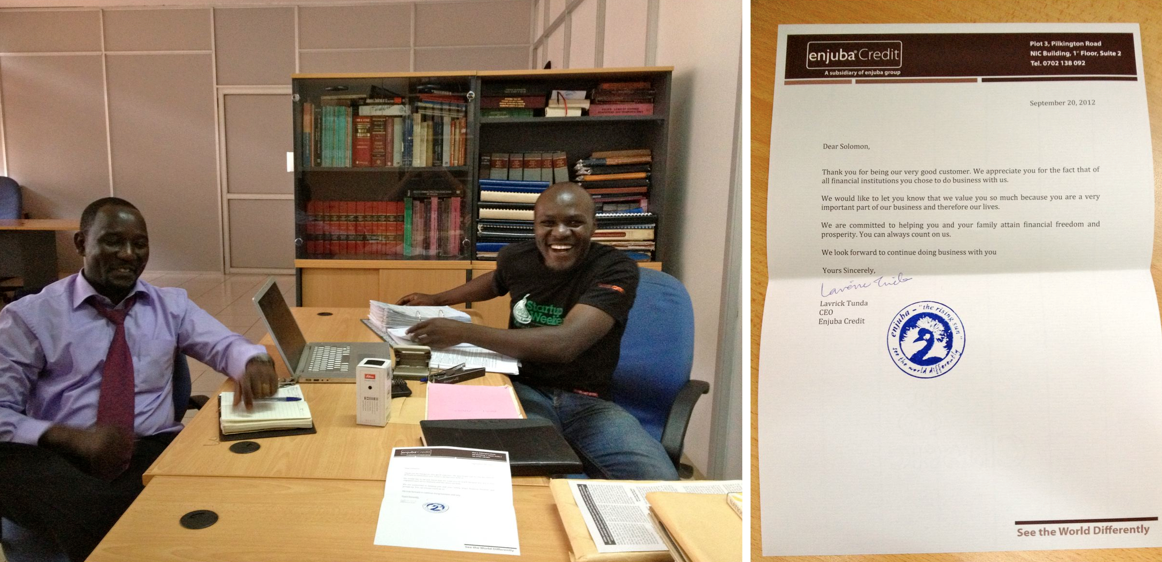

2010-present

The main focus of Aaron Kirunda since 2010 has been transforming the enjuba brand into a bank, now called enjuba Credit, in order to bring more economical financial services to Uganda. Enjuba Credit currently gives out short term loans to individuals and is developing a long term loan program for the future. The company also allows individuals, businesses, hospitals, and other organizations to securely and inexpensively send money and pay bills using their mobile phones, and it allows customers to make cash deposits and withdrawals by crediting or debiting their phone accounts. Aaron’s business has hundreds of customers and has facilitated thousands of transactions.

Enjuba is also working to design, develop, and host a national spelling bee with the intent of having more parents actively engaged in the education of their children within the context of an exciting competition. Aaron intends to introduce words such as responsibility, accountability, transparency, and anti-corruption, and ensure that the kids understand the full context and implications of these words. Enjuba Credit will be the main driver of this initiative, but Aaron intends to get numerous other companies and organizations to support the Enjuba Spelling Bee.